The World’s First Small-Scale Fisheries Impact Bond

Project Lead: Rare

Financial Support: The UK’s Blue Planet Fund

Location: Indonesia

Project Timeline: Ongoing (2024 – 2025)

Summary

Rare is launching the world’s first small-scale fisheries (SSF) Impact Bond, focused on increasing sustainable, community-led management of coastal and marine resources while improving the livelihoods and formalisation of the SSF sector.

Through the Impact Bond, Rare will establish five Managed Access with Reserves (MA+Rs) areas, a system for artisanal fishers that balances sustainable use and protection through reserves. The MA+Rs will be implemented within Marine Protected Areas (MPAs) or as Other Effective Conservation Measures (OECMs) in Southeast Sulawesi, Indonesia.

By establishing and sustainably managing new MA+R sites, Rare will help strengthen coastal marine habitats including coral reefs, mangroves, and seagrasses. The MA+R sites will help build capacity and formalisation of micro and small businesses, bringing artisanal fisher microbusinesses into the formal economy and strengthen their capacity along the domestic value chain.

Challenge

Small-scale fisheries play a vital role in coastal communities, contributing heavily to food security, employment, economic growth, and climate resilience. Unfortunately, they face a variety of systemic challenges. Chronic underfunding and shortage of resource, compounded by the sector’s informality, hinders its ability to absorb necessary capital. Such a lack of sustainable management and marine resource protection is reflected within the Ocean, leading to plummeting Ocean biodiversity, and creating an existential crisis.

Solution

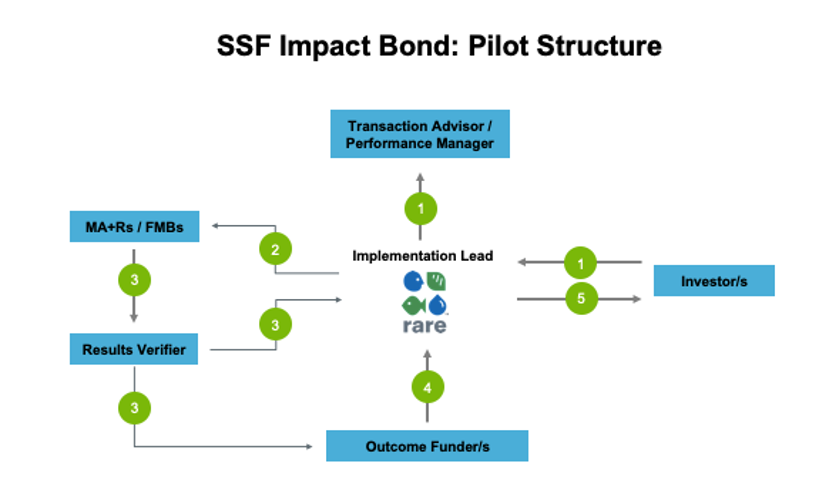

Rare’s Impact Bond is an Outcomes-Based Financing (OBF) Model to exclusively support SSF. The model will offer a return on investment when predetermined project milestones are achieved.

The core repayment metric is in square kilometers of protection, which Rare aims to achieve by establishing MA+Rs. The outcome metrics for interest being considered include biomass stabilization and/or recovery and coral reef health. The structure therefore contributes to the protection and regeneration of valuable coastal and marine natural assets and resilience of climate vulnerable coastal communities.

- Investors: The total investment is size is $3.6 million, to be provided by one or more investors.

- Outcome funders: The Department of Environment, Food, and Rural Affairs (DEFRA) via a Contribution Agreement with ORRAA is supporting the structure as an outcome funder. Rare is in active conversation with additional outcome funders to be announced at contract closing.

- Service providers: Levoca (performance manager), Reed Smith (legal counsel), PKSPL IPB (independent third-party evaluator).

- Initial Funder: Pershing Square Foundation provided the funding to complete the impact bond’s feasibility study and design.

- Data provider: Government of Indonesia.

Projected Impact

With ORRAA’s support through the UK’s Blue Planet Fund, Rare aims to:

(1) Mobilise USD $3.6M in investment to unlock USD $9.7M in grant capital in the first Cohort.

(2) Support 70,000 people.

(3) Increase an estimated 60,000 ha of ocean protection by establishing 5 MA+Rs.

(4) Stabilise biomass and benthic coverage through sustainable MA+R management.

(5) Establish community-led Fisheries Management Bodies as legal entities.

(6) Formalise SSF microbusinesses and strengthen their capacity.

Scaling and Next Steps

Rare completed a feasibility study for the SSF Impact Bond1 in 2023. Now, with support from ORRAA through the UK’s Blue Planet Fund, this project will pilot the proof-of-concept model, aiming to unlock around USD $10M of private, philanthropic and public funding in the first cohort.

The Project has a clear scaling pathway. Cohorts 2 and 3 are planned to be launched in 2026 and 2027-2028, respectively, covering between 25 and 50 new MA+Rs across Indonesia and the Philippines (Cohort 2) and between 50 and 100 new MA+Rs to be determined in Rare Fish Forever countries across the Global South. There is a planned implementation period of five years, respectively.

[1] The Feasibility study was funded by Pershing Square Foundation.