Establishing a Blended Finance Facility for Marine Protected Areas (MPAs)

Project Lead: Blue Alliance Marine Protected Areas

Supporting partners: Governments of Indonesia, Philippines, and Tanzania during the initial phase, alongside AXA Climate, BNP PARIBAS, Blue Natural Capital Finance Facility (BNCFF), Fondation Hans Wildorf, Global Eba Fund, Global Fund for Coral Reefs, Howden Group, Mirova Natural Capital, Mirova Nature+, MAVA Foundation, UBS Optimus Foundation and UN Capital Development Fund

Financial Support: Government of Canada

Location: The Bahamas, Belize, Cabo Verde, Dominican Republic, Fiji, Indonesia, Mozambique, Philippines and Tanzania

Summary

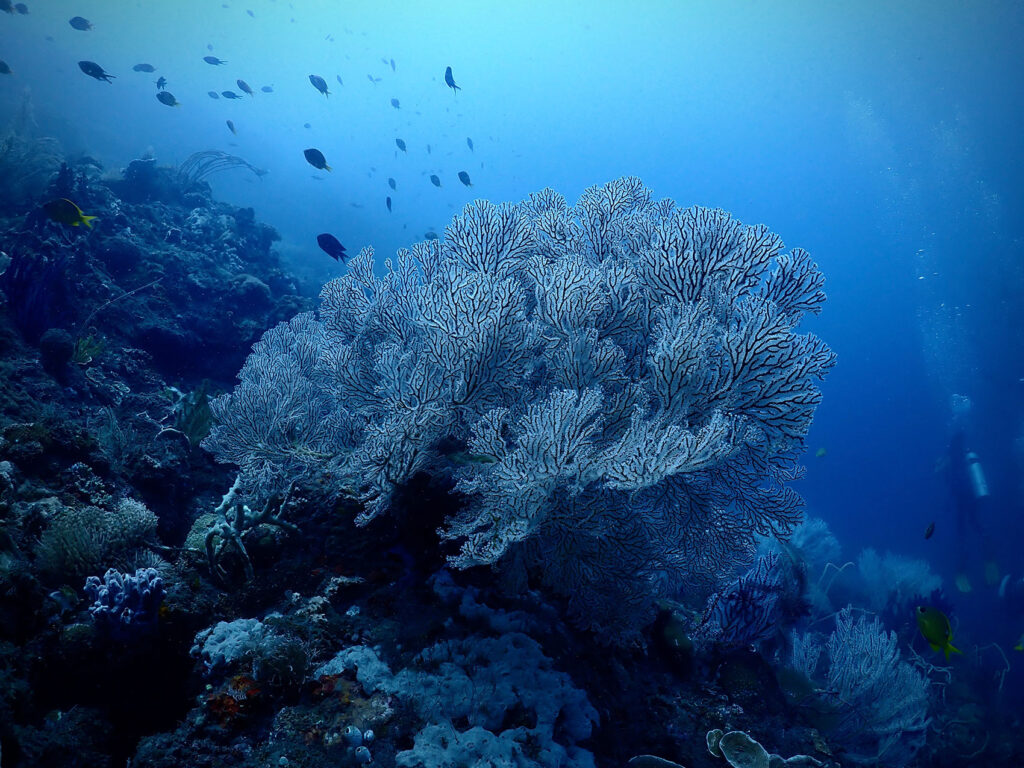

ORRAA is working with Blue Alliance to structure a blended finance facility which will implement sustainable revenue-generating initiatives in marine protected areas (MPAs). These aim to enhance the protection of over 1,000,000 hectares of high-biodiverse coral reefs and have a positive impact on the local economy, including coastal fishing communities. The initial phase will focus on working with NGOs in Indonesia, Philippines, and Tanzania to manage ‘bankable’ MPAs, on behalf of Governments. It will also prepare new MPA financing mechanisms in Belize, Bahamas, Cabo Verde, Dominican Republic, Fiji, and Mozambique.

Challenge

Approximately 500 million people depend directly on coral reefs for food and income, but 60 per cent of those ecosystems are under immediate threat from human activity and climate change. MPAs are a proven tool to reduce the various drivers of coral reef ecosystem degradation. Benefits that flow from improved marine ecosystems include enhanced food supply and fishing incomes for coastal communities, opportunities for nature tourism businesses, shoreline protection, and greater resilience to climate change.

However, 70 per cent of the MPAs globally struggle to meet minimum management standards due to piecemeal, insufficient, and short-term funding, which is largely provided by public bodies and development finance entities. Blended finance – incorporating public and private funding – can play a key role in mobilising additional funds from impact investors.

Solution

Blue Alliance is structuring a blended finance facility to provide up-front and early-stage capital for the management of 10 sustainable MPA networks in the Global South. This project will contribute to the effective management and the financial sustainability of these MPAs.

The facility seeks to invest over USD$22 million in grants, refundable grants, impact loans, loan guarantees, and innovative insurance solutions. The revenues generated from a range of sustainable sources, such as eco-tourism fees, blue carbon, and sustainable artisanal aquaculture, will create tangible returns for investors, and demonstrable impact for donors.

The facility aims to protect over 1,000,000 hectares of coral reefs, benefiting approximately 20,000 vulnerable people in coastal communities and unlocking domestic and international private investment capital. This project replicates work by Blue Alliance to implement an innovative blended finance mechanism for the effective management of the Turneffe MPA in Belize – one of the largest in the Caribbean.

Scalability and Next Steps

The facility can be effectively tailored to the various contexts and needs of different sites and communities. During its initial phase (2022-2023), it will invest in three MPA networks located in Indonesia, Philippines and Tanzania — where Blue Alliance and local community partners have been working since 2019. The facility will then be upscaled to the other seven networks between 2023-2026.

The overall design and structure of the facility and its investment pipeline is readily transferable to other countries and regions. A pipeline of 200 potential opportunities has been identified worldwide, based on positive ecological and social impacts that can be achieved in protecting and enhancing critical natural capital in the regions, the business model feasibility, and the existence of local support and capacities. Whilst the initial sectoral focus will be revenue streams associated with eco-tourism and ecosystem service payments (particularly blue carbon), other sectors capable of driving sustainable income into MPAs can be bundled within the structure of site-specific projects.